xThe Oily Swindlers of the Pennsylvania Boom

As part of our Global Commodities resource, I have recently been working with some fascinating materials that document significant aspects of the U.S. oil boom in the mid-late nineteenth century.

Edwin Drake’s discovery of oil in Pennsylvania in 1859 is considered one of the major catalysts of the oil boom in the United States, but there were some who had already found ways to turn this seemingly useless substance into something profitable. Samuel M. Kier was one such character, and his “NATURAL REMEDY”, or panacea, to aid practically any given ailment (including total blindness, burns, rheumatism, chronic coughing, cholera, dysentery, sprains, bronchitis, asthma, tooth ache, deafness and piles) consisted of bottled crude oil at 50 cents a pop. His advertisement “Petroleum, or Rock Oil. A Natural Remedy!” recommends rubbing, ingesting or pouring the oil into or onto any of the affected areas for complete relief...

Kier’s 'magic fluid' didn’t make his fortune (that came later), but it certainly sold well. Kier went on to develop refining techniques to make lamp oil, and is credited with being the first to do so. Some have gone as far as to label Kier ‘the grandfather of the American oil industry’. His early exploits in pharmaceuticals are somewhat reflective of the swindling and cheating that was to follow.

After Drake struck oil in 1859, production boomed from around 2,000 barrels in the first year, to over 3 million in 1862. Land speculation and fraud was running rife, and hundreds of companies emerged, each claiming to have discovered the next big well. A writer at the time shared his opinion on the matter: “their lands, where any title to lands really exists, have no indication of the presence of oil in quantities to warrant boring. The only object of their existence was the creation of shares to be sold at a profit by sharp-witted projectors.”

Hundreds of oil company prospectuses circulated the towns, each claiming to have procured land under which their fortunes lay hidden. As I was working through these prospectuses — which will shortly be added to Global Commodities as part of the collection of material relating to oil — I stumbled across a satirical leaflet that launches ridicule at those individuals who made such farcical claims in their efforts to swindle investors. The (bogus) Prospectus for the Munchausen, Philosopher’s Stone & Gull Creek Grand Consolidated Oil Company claims a capital stock of $4,000,000,000, a working capital of $37.50 and seven hundred and fifty three million acres of oil territory in which to drill. The pamphlet mockingly describes the Munchausen Well as being particularly profitable as it struck not only oil, but also ale, lottery tickets, milk of human kindness, Billy Patterson and a leak! These intriguing documents, and many others relating to oil, will shortly be published as part of Global Commodities and help elucidate the fascinating history of what has become one of the most powerful and influential commodities on earth.

These intriguing documents, and many others relating to oil, will shortly be published as part of Global Commodities and help elucidate the fascinating history of what has become one of the most powerful and influential commodities on earth.

Recent posts

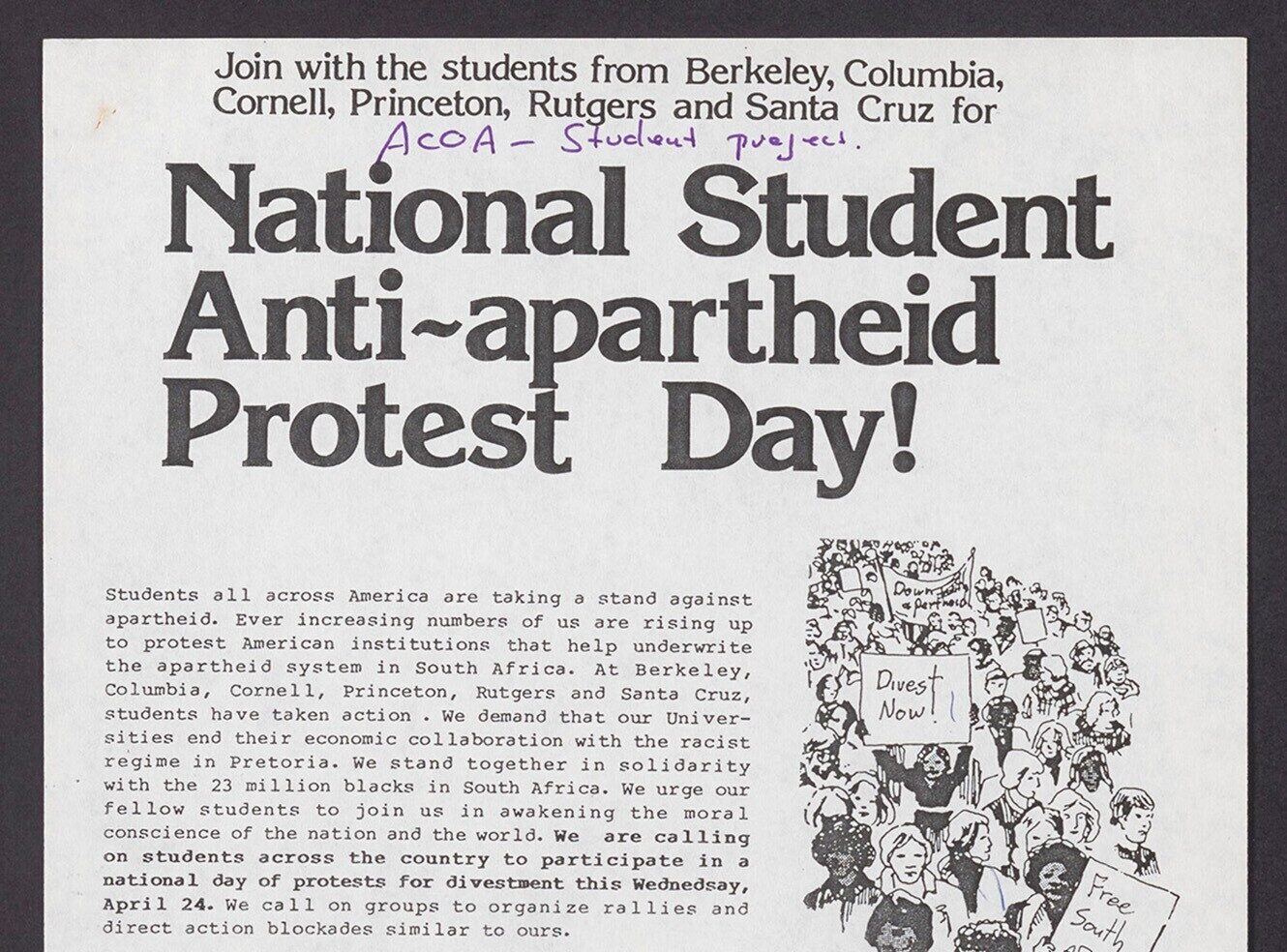

The blog highlights American Committee on Africa, module II's rich documentation of anti-apartheid activism, focusing on the National Peace Accord, global solidarity, and student-led divestment campaigns. It explores the pivotal role of universities, protests, and public education in pressuring institutions to divest from apartheid, shaping global attitudes toward social justice and reform.

This blog examines how primary sources can be used to trace the impact of young voices on society, particularly during pivotal voting reforms in the UK and the US. Explore materials that reveal insights into youth activism, intergenerational gaps, and societal perceptions, highlighting their interdisciplinary value for studying youth culture, activism, and girlhood across history.